Your cash flow statement helps you understand how much free cash flow your company has at its disposal. Once you know how to keep your records organized, it’s time to move on to the next step, choosing an accounting method. When you use accounting and bookkeeping together, you can keep track of your financial figures. We recommend consulting a financial advisor and an accountant familiar with the ecommerce space. They can help you to group similar items together for a more streamlined management of your accounts. However, you’ll want to consult a professional or someone in the ecommerce space as early as possible.

It enables you to report actual how to check if an ein is valid and precise figures when tax time rolls around. From keeping track of your daily sales to having proper records in place for tax time, managing your books should never be put on the sidelines. Keeping your records straight and accurate ensures your business operates efficiently and legally, too.

Equity Accounts

- This extremely helpful document keeps track of cash and cash equivalents coming into your online store and going out, too.

- The most common numbering system is using the numbers 1000 through 5999.

- Equity is defined as the value of your business after subtracting all liabilities from your assets.

- If you’ve set it up right the first time, you won’t have to worry as much about adjustments.

- This account is where you record payments for loans or installment fees, accounts payable, accrued liabilities, and the like.

For example, a brick-and-mortar store might not deal with shipping costs or revenue from charging shipping fees. However, as an e-commerce business, it would be useful for you to see these transactions distinguished from other costs or revenue from goods sold. However, these two concepts go hand-in-hand when running your ecommerce business. Accounting, on the other hand, is the interpretation of those business transactions.

Using a break even point calculator can help you determine if your sales will be enough to cover your costs and to what degree. With this calculator, you’ll be able to figure out how many products you must sell to break even. You’ll also know how many products you must sell to hit your what is negative goodwill and its accounting treatment target gross profit.

This can determine how simple or more robust your chart of accounts needs to be. You can use historical data from previous periods or industry benchmarks to make these estimates. You should also account for seasonal variations in demand or supply that may affect your revenue or costs. You can also build your own chart of accounts using this free downloadable sample chart of accounts for Commerce business. Discover how Receive is revolutionizing e-commerce cash flow and eliminating payout delays ⎯ zero fees, zero interest, and zero credit impact. Learn how to navigate UK & EU VAT rules, avoid common pitfalls, and streamline your accounting.

Neglecting Industry-Specific Needs

The best way to organize the accounting and bookkeeping items is to put them into a form you can understand. This is possible by creating a financial roadmap with a chart of accounts, or general ledger. A chart of accounts is income statement formula essentially a list of categories that an organisation sets in order to distinguish financial transactions. In general, the high-level categories will be assets, liabilities and shareholder’s equity for the balance sheet, and revenue and expenses for the income statement.

Create Business Accounts

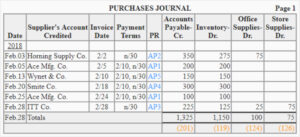

Examples of bookkeeping tasks include managing invoices, inventory, payroll, accounts receivable, and accounts payable. Your e-commerce chart helps you see all financial accounts, including assets, liabilities, revenue, expenses, and equity, in a hierarchical manner that will inform all other decisions. Your chart of accounts serves as a map of your business and its financial components. So, making sure you have the right chart of accounts in place for your ecommerce business will create real value for you.

Once you have created a budget, you should compare it regularly with your actual results and analyze any possible variances. This will help you identify areas where you can improve performance or reduce costs. The most common numbering system is using the numbers 1000 through 5999.

Maybe the holidays will bring in more revenue, or maybe it’s the summertime that does best. Either way, cash flow planning will help you manage the months when cash flow is lower. The two most important things to look for in accounting software are platform integration capability and reporting. Like merchant accounts, integrating your accounting software into your preferred online marketplace or platform can automate your sales tracking and save you a lot of effort. Most of the big names in the industry can be integrated, but look at your platform for more information. A chart of accounts is a list of all the individual accounts used by the eCommerce business.

To simplify some of the process, you can use an accounting integration that automatically creates relevant sub-accounts and maps transactions to the corresponding sub-account. With that said, it’s essential to know when you can’t do it on your own. If something listed above is way out of your comfort zone or you don’t have the time to do these accounting tasks well, ask for help. You should focus on the tasks you do best and outsource the jobs you really can’t do or don’t want to do. Income statements come in handy to pick up on sales trends, predict future performance, and monitor your key performance indicators (KPIs).